Creating a portfolio that withstands inflation needs a strategic technique, focusing on assets that protect or increase in value as price ranges rise. Here’s ways to composition your investments for inflation resilience:

Retirement accounts are powerful tools for wealth constructing and preservation due to their tax strengths, growth prospective, and legal protections. Below’s how they're able to enhance your wealth management approach and support to keep up your wealth:

Listed here’s another entry that might surprise you: Non-public credit. Why can it be one of the best long-lasting investments? Look at this: A short while ago, investment huge KKR conducted a study examining the main advantages of including alternative investments into the standard “sixty/40” portfolio about almost a century of returns.

Syed claims Superb overview. The significance of tax sheltered accounts can’t be overstated. Especially if you’re able to secure a match into your 401k.

Paul Katzeff is undoubtedly an award-profitable journalist who has composed four publications regarding how to increase your 401(k) retirement nest egg and 1 about Web investing. He has worked as a senior reporter/author at Investor's Company Daily, a correspondent for Mon...

They're necessary to distribute not less than 90% of their once-a-year taxable cash flow to shareholders by using dividend payments, so they have a tendency to offer extremely desirable dividend yields.

MarketBeat keeps observe of Wall Street's top-rated and best performing exploration analysts as well as shares they advise to their customers daily.

By making a comprehensive list of estate arranging documents, you can offer very clear assistance and comfort in your loved ones while making certain that your wealth is secured and distributed As outlined by your needs.

Some could also offer diversification Rewards or defensive attributes, notably for traders who may need sizeable exposure to mega-cap US advancement shares.

For business owners and traders, limited legal responsibility entities may be strong tools for developing wealth and protecting it from probable risks.

Staying in advance of inflation involves Lively portfolio management and remaining educated about economic developments. Here are some recommendations:

When Everybody understands the necessity of economical stewardship and is supplied with the information and capabilities Visit This Link to create good income selections, the potential risk of wealth erosion decreases substantially.

Advance healthcare directive: Often called a residing will, this doc outlines your needs for clinical treatment method For anyone who is unable to speak them by yourself.

As the expense of merchandise and services rises, the paying for electrical power of your hard earned money decreases. This causes it to be very important to prepare for and mitigate inflation as you Construct wealth extensive-phrase.

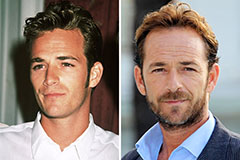

Luke Perry Then & Now!

Luke Perry Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Kane Then & Now!

Kane Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!